Advisor Group declared options Thursday to acquire Infinex Economical Holdings, a broker/seller that presently supports much more than 230 local community-centered banking companies and credit history unions. While Advisor Team does have an present presence in the monetary establishment current market, mainly as a result of its Securities The usa subsidiary, this offer provides the b/d network a foothold in that current market on a a great deal greater scale.

“As we feel about where by AG wishes to placement itself in the long term, we’re wanting at growing our addressable sector on a quantity of fronts, and one particular of them was the economic establishment section of the sector,” claimed Greg Cornick, Advisor Group’s president, Advice and Wealth Administration.

Infinex, which has around 750 advisors and $30 billion in belongings, will not be built-in into just one of Advisor Group’s other b/ds relatively it will become its seventh subsidiary, with its Meriden, Conn.–based back-place of work functions and govt management group remaining intact. Infinex will go on to crystal clear through Pershing, just one of Advisor Group’s clearing firms, so there will be no repapering of consumer accounts.

“We are not heading to disrupt the business by any usually means in fact, the entire concept of it staying introduced more than as an additional wealth management agency in our ecosystem can allow for it to go on to work, but what we can convey with any luck , to the desk here is that incremental cash and backing of Advisor Team that will let for Infinex, which has by now experienced excellent development, to even turbocharge that progress even more,” Cornick reported.

Advisor Team estimates that there’s $1 trillion in belongings sitting in financial commitment plans at economical institutions, representing a huge market for the company.

“There’s an untapped prospect that we see in economical establishments for these companies,” mentioned Tim Kehrer, director of investigation at Kehrer Bielan Study & Consulting, which tracks the financial institution brokerage and insurance policy industries.

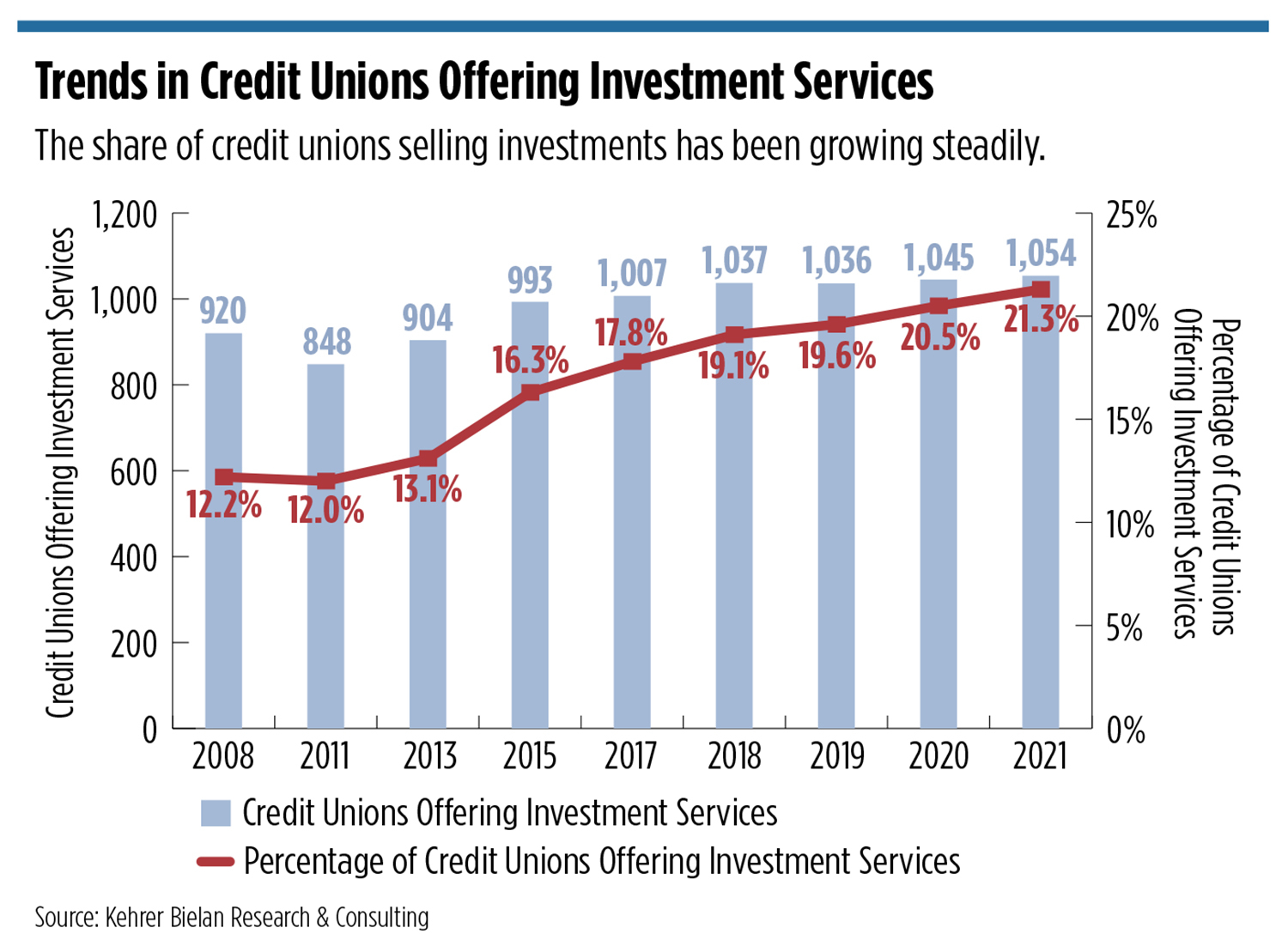

Kehrer reported the share of credit history unions marketing investments has been steadily increasing over the past 10 years. And his analysis demonstrates that just 25% of community financial institutions are at the moment providing financial commitment providers, indicating there’s area for advancement.

“Our investigate suggests that the regular financial institution need to have twice as numerous advisors as they have, which means 2 times as much belongings, two times as much earnings and so on,” reported Kenneth Kehrer, principal at the consulting agency.

The standard bank has just one advisor for each and every $350 million in core deposits, but Kenneth Kehrer stated he sees firms undertaking it successfully with one particular advisor per $125 million in main deposits.

“Firms that are really prosperous in this small business and are encouraging to expand advisors and so on, as perfectly as aid them increase their specific procedures, see an possibility to go into this farmland that’s been farmed, but not farmed as nicely as it could be,” Kenneth Kehrer explained.

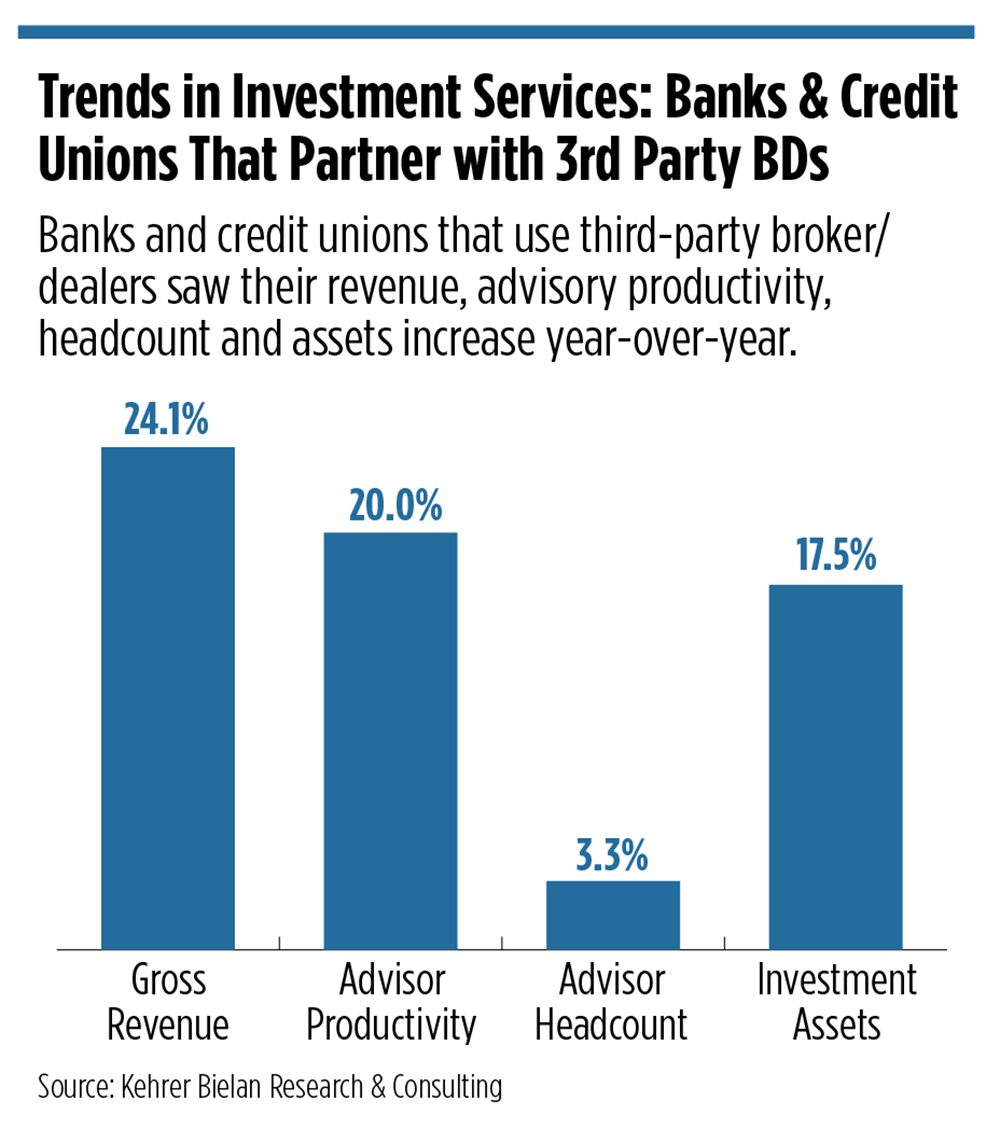

Even further, banks are progressively outsourcing the brokerage responsibilities to 3rd-bash broker/sellers, such as Infinex. 10 a long time in the past, for instance, there had been 80 bank-owned b/ds now there are just 37, he said. The escalating regulatory hazards and technological know-how commit expected to stay competitive have become unbearable for lots of financial institutions.

“You’ve bought a whole lot of financial institutions and credit history unions wanting at this and imagining about strategies, in terms of exactly where their strengths are, that they can probably outsource, and 1 way is a partnership with a business like ours to build a 1 in addition a person equals a few situation,” Cornick stated.

Advisor Team joins other independent broker/dealers, these kinds of as LPL Financial, in producing a devoted channel for monetary establishments.

LPL has recently made a extra concerted exertion to support these companies and now serves about 800 monetary establishments. Very last June, the firm introduced on Shawn Mihal, previous president of Waddell & Reed Inc., the broker/seller subsidiary of Waddell & Reed Financial, to guide institution providers. And in early 2021, the business launched the Institution Business Strategy office, focused on the evolution of fiscal institutions as they recover from short-term branch closures brought about by slowly and gradually retreating pandemic limits. Large fiscal establishments have turn into a new resource of development for the agency in 2021, with the addition of BMO Harris and M&T. CUNA Mutual Team will changeover its wealth administration company this calendar year.